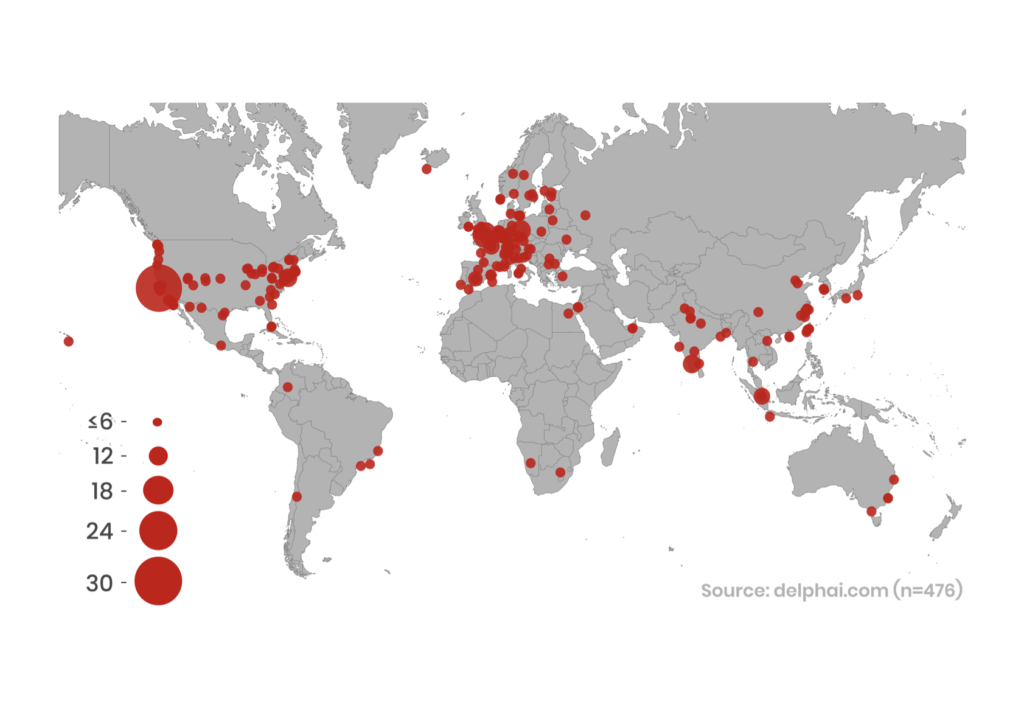

1. Europe is the leading hotspot. Most of the 476 micro-mobility companies worldwide are based in Europe, followed by North America and Asia. At the country level, the US leads with 148 companies, trailed by Germany (43), India (25), France (23), and China (22).

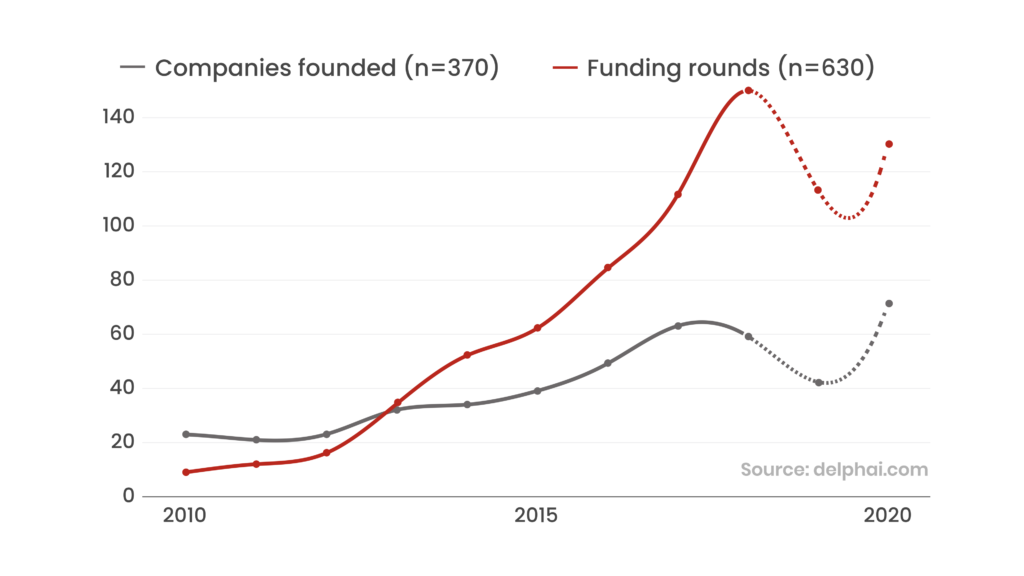

2. The market has witnessed aggressive expansion. Between 2009 and 2018, the rate at which new firms entered the micro-mobility space more than doubled, from 18 new companies founded in 2009 to 59 in 2018. Investor appetite also burgeoned in parallel, with the number of funding rounds leaping 21-fold from 6 rounds in 2009 to 134 in 2018. Meanwhile, yearly venture investments grew from a total of €14m in 2008 to €5.5bn in 2018.

3. Signals of market consolidation. Investment activities indicate a new phase of market development, as existing companies are raising large follow-up financing for scaling, and as rivals are acquired to expand market share. Examples include Bird’s acquisition of Circ Mobility in January following a €68m Series D round, as well as TIER Mobility taking over 5,000 Coup e-mopeds (discontinued in November 2019) and its charging infrastructure following a €91m Series B round.

About this briefing:

This briefing is a part of a delphai collaboration with Tagesspiegel Background, in which delphai’s artificial intelligence tools are used to provide Background with data insights on the technologies, companies, and applications that drive global innovation.

The data and analyses you see here are a summary of what delphai provided to Tagesspiegel Background for its article Micromobility: from hype to crisis.

About delphai:

delphai is a market intelligence software that uses AI for the automatic analysis of market and technology developments. The software is used by companies to create insights that help them seize opportunities, manage risks, and make better decisions.

To learn more about this report, or how delphai can help your company grow, please get in touch here.