Whether private equity, financial loans, venture capital, or institutional investors. Sustainability analysis has become an integral part of the due diligence process businesses must undergo to attract funding. In fact, more than 1,500 investment professionals across Europe, and more than 700 in North America, have signed the UN’s Principles for Responsible Investment as of June 2020.

Tracking and reporting progress towards better sustainability has become crucial for businesses pursuing external investment and aiming to win consumer trust.

Here is an overview of the most commonly used sustainability frameworks, providing insights into how automation accelerates sustainability analysis, and its impact on investment readiness.

You can’t change what you don’t measure

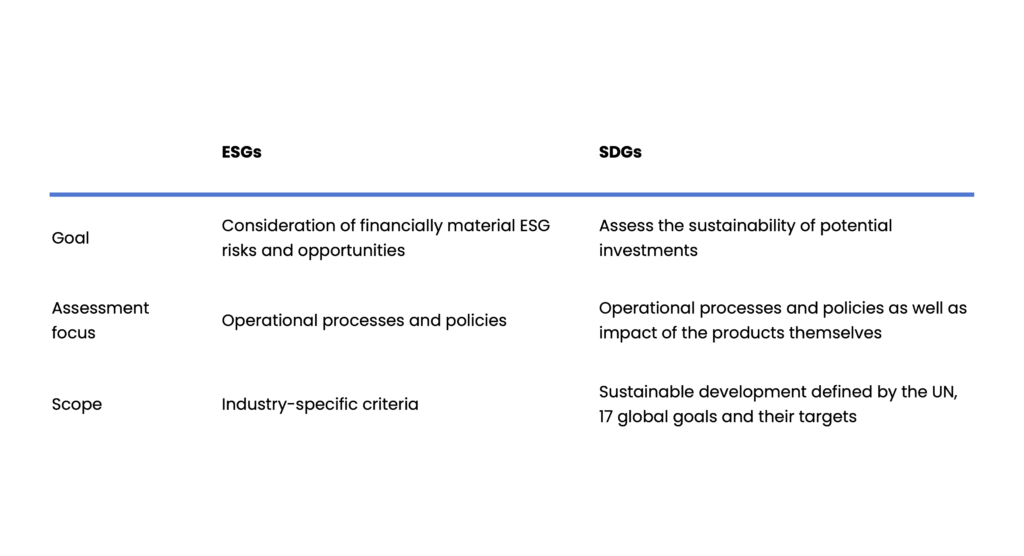

By 2010, the environmental, social, and governance principles (ESGs) started to emerge as a complementary performance measure to financial return, with the goal to indicate the sustainability of potential investments. But because the ESGs focus mainly on processes and policies, and don’t measure the impact of products or services, they have been criticized by investors, as they lack direction and strategic value.

The Sustainable Development Goals (SDGs) on the other hand, have rapidly gained popularity among investment stakeholders. The 17 goals — divided into 169 targets — provide a powerful framework to guide structured investment appraisal. Investors can now effectively track, and compare progress across portfolios.

Which framework suits your business?

Sustainability analysis has become an unavoidable step on the way to investment readiness. The following chart compares the ESGs with SDGs in greater detail.

New investment readiness standards

A combination of ESG- and SDG-based sustainability analysis has become the norm. Companies priming themselves to become investment-ready must now include a combination of both ESG and SDG frameworks to meet investor expectations. As both ESGs and SDGs have become part of the exclusion criteria and now define the strategic direction of reputable investment portfolios.

Investment readiness hack: automating your sustainability assessment

The increasing importance of sustainability analysis for investment readiness means that companies are facing additional reporting requirements above and beyond financial returns. If done manually, this can add months to the roadmap towards acquiring capital. Furthermore, leveraging sustainability data efficiently has emerged as a key competitive advantage among aspiring market leaders, especially stock-listed firms.

Artificial intelligence (AI) can significantly shorten the path to investment readiness by automating sustainability reporting.

The SDG framework naturally lends itself to automation because:

- Algorithms analyze unstructured data providing a detailed overview of the existing impact and touchpoints related to the 17 goals

- The results offer insights into opportunities for companies to increase positive impact or decrease the negative impact

- Companies are able to easily compare their SDG touchpoints and find potential partners across industries

- The SDGs provide a common language that ensures understanding among stakeholders and customers

Fast-tracking investment readiness

Automating sustainability analysis with AI means accurate, fast, and reliable results. Where humans need weeks to go through internal documentation to determine a company’s sustainability impact, AI leverages Natural Language Processing to label unstructured data and visualize SDG touchpoints within seconds.

As a result, companies can compare their sustainability imprint with their competitors’, know where they stand within their industry, and identify potential partners. By automating data processing, sustainability analysis is transformed from a reporting mayhem to a competitive advantage; fast-tracking companies into investment readiness.

If you are a business leader interested in accelerating investment readiness, get in touch to find out how to benefit from delphai.